Carbon Credit Exchanges Taxable

The carbon market is a global industry that seeks to reduce greenhouse gas emissions and increase the storage of captured CO2. Trading and exchange platforms are designed to enable individuals, businesses and governments to buy and sell carbon credits.

A carbon offset is an instrument certified by government or independent certifying organizations to represent an emission reduction, removal, or improvement in greenhouse gas (GHG) emissions or GHG sequestration. These offsets can be used by companies or individuals to compensate for the emissions of one metric ton of CO2 or other GHGs measured against a counterfactual baseline.

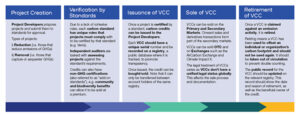

The voluntary carbon credit exchange offsetting market operates outside the regulatory system and is driven by demand for carbon offsets from private individuals or corporations with corporate sustainability targets, governments, and other actors aiming to trade credits at a higher price to make a profit. The supply of voluntary carbon credits comes from projects that use a variety of technologies and techniques to reduce or capture emissions.

Are Carbon Credit Exchanges Taxable?

Compliance carbon offsets are created by projects that meet national, regional, or international emissions regulations. These projects may be developed by governmental agencies, nonprofits or other entities. These activities reduce or avoid greenhouse gases, such as carbon dioxide (CO2) or methane, which is a natural gas. This can happen through a range of processes, including forestry practices that plant trees. Carbon offsets are traded on a carbon market, which is an online exchange that allows individuals, businesses and governments to purchase and sell these offsets. The market is categorized into two submarkets: compliance and voluntary.

As countries pursue net-zero emissions goals, carbon pricing and emission trading systems are gaining popularity as a way of reducing carbon emissions. Many of these systems are implemented at the local, regional, and national levels, although the global average price is only $2 a ton, far below the level needed to avoid dangerous climate change.

Some governments use carbon taxes to directly set the cost of carbon and to encourage companies and households to reduce emissions. Such taxes increase the price of carbon-emitting fuels, such as coal and oil products, and are often passed on to consumers. This can provide a boost for energy efficiency, and can also encourage investment in clean technology that will help to lower carbon emissions.

The United States has introduced a carbon capture and sequestration (CCS) tax credit that is designed to reduce the cost of developing CCS projects, which have the potential to bury or capture carbon dioxide. However, the rules for the tax credit are complicated and are likely to be challenged by investors. Whether the purchase of VCOs is tax deductible as trade or business expenses depends on a variety of factors. The IRS expects companies to justify their expenses and document the nature of them in order to make an effective deduction.

The IRS has taken a more flexible approach to the treatment of ESG expenditures over time. While it may still be difficult to determine whether a company’s VCO purchases are “ordinary and necessary,” it is increasingly expected that costs that are related to satisfying external stakeholder expectations can be deducted under Section 162 of the Internal Revenue Code.